Canada’s own Alanis Morissette said it best…”And isn’t it ironic…don’t you think?”

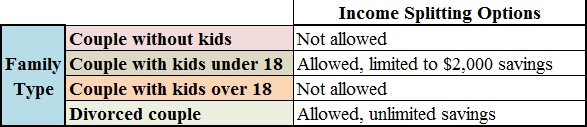

There is a hidden and cosmic irony that exists in our country, an issue that has been front and center in the news lately and a huge factor in the upcoming election: income splitting. It turns out that parents who divorce can save much more money from income splitting than married couples can (or common-law couples). A special shout out to my friend Mark who first mentioned this concept to me and helped plant the seed of this post (ironically, at a Just for Laughs show). Here’s a quick table (I love tables!):

We of “Team Married-With-Kids-Under-18” are limited to $2,000 in savings when we income split with our spouse (at least those of us who qualify for the credit since there are other limits as well). Families who don’t have children or have children over 18 get el-zippo, which is just a bit nuts because they’re also FAMILIES. Strangest of all, those on “Team Divorced” have no limits on the income split. People on “Team Divorced” can split their income any which way they like…if the wife earns $80,000/yr and the husband stays at home with the kids and has zero income, they can agree to spousal support payments that would save them THOUSANDS of dollars per year (the savings are of course their savings as a couple….even though they are no longer a couple).

So…..sorry I got ahead of myself a bit there….I was just getting over my anger that divorced families who make the exact same money as my family are better off!!!

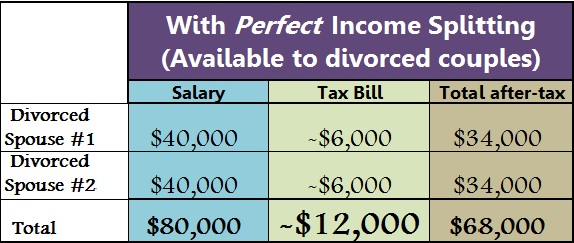

For those of you totally confused by the above: What is income splitting, you ask? Easy! It’s a way for families to divide up their income so that if one spouse is earning more than the other, the higher-earning spouse can allocate some income to their lower-earning spouse’s tax return to take advantage of their lower tax rate. In reality, it’s more complicated than that but that’s the general concept. Is income splitting a good idea? You bet! Why should 2 families that both have total income of $80,000 pay different amounts of tax? If the wife earns $80,000 and the husband stays home with the kids and doesn’t have any income, why is this family punished by paying more tax?! Check out these awesome tables (the numbers are just for illustrative purposes!…and you were warned above – I LOVE tables):

So that seems pretty good right? Problem is, in reality (discussed above and seen in the 2nd chart with the blue header) you can only save a maximum of $2,000 from splitting income with your spouse. Therefore, the family above can’t reduce their tax bill to $12,000…..they can only lower it from $20,000 to $18,000! The divorced couple though?….they can reduce their joint tax bill to just $12,000 (chart 3)….I think I’ll send Alanis a tweet, maybe she’ll add a verse to her song.

Without getting too deeply into the politics of all this income splitting chit-chat, I’ll just summarize each party’s position:

- Conservatives: Love it, think it’s a perfect system that benefits everyone and all Canadians should buy them flowers and chocolates and give them massages as a reward for creating perfection.

- Liberals: Hate it, will get rid of it if elected, say that it favours the upper-middle class and the wealthy. Will want the same rewards as above once they scrap the program (if elected)….which would kind of suck because even $2,000 savings is still $2,000 in savings (and there are those in the lower-middle class and middle class who benefit…)

- NDP: Hate it, will get rid of it if elected, say that the money is better spent on a (badly thought out) national daycare program (which will need even more funding through higher corporate taxes). Same suckage as above with the lost $2,000, plus higher corporate taxes will be bad, for a whole lot of reasons. (The NDP gets ZERO massages from me!)

My point is this – while the current income splitting system is a stepping stone to a fair system, it appears to have a long way to go in terms of being anywhere near fair. With the Liberals and NDP wanting to scrap the current program, it makes me think that maybe there are better ways to spend a few billion dollars….

Stay tuned as we let this information sink in…. and I’ll give some thought as to how we can all eventually enjoy the many benefits of divorce….without actually getting divorced.

Sincerely,

The Funny (and now over his anger) Accountant

If you like what you read, please like my Facebook page and/or follow me on Twitter! And, as always, if you have tax questions, need advice on your personal taxes, corporate taxes or anything else accounting or business related, please contact me (Mitch Kujavsky), AKA The Funny Accountant, either by phone at (514) 833-1158 or by e-mail at mitch@mkassociates.ca.

Also, for a witty and insightful read, check out the wifey’s blog. It’s funny and good.

In case you missed it, here’s the audio from my appearance on CJAD, chatting with Dan Delmar about the UCCB increase and other family related tax stuff!

[…] Author’s note: If you followed a link directly to this post, don’t forget to check out the follow-up blog post on income splitting! […]

LikeLike

Test.

Seeing if this posts somewhere.

LikeLike

Test passed lol!

LikeLike

I have to say it would be great if income splitting was available in the UK. We are trying to get rid of the gender pay gap and encourage more women back into work after having children. With daycare being so costly it doesn’t make a lot of sense for a lot of families for the child carer to return to work and pay childcare fees. Income splitting would seem like a sensible option. Not a panacea but a move in the right direction

LikeLike

And now in canada…. a huge benefit to getting divorced with the new liberal CCB. A psedo legal paper divorce will net a family with one high income earner up to $5k/yr/child in Canada Chlld benefit on top of the ability to income split.

LikeLike

[…] couples with kids). To that cut, I say good riddance, for reasons I chatted about in a previous post…but mostly because it fully discriminated against married or common-law families who […]

LikeLike