If you’ve been following the news these past few weeks, you probably know that there are big changes coming to our taxes here in Canada. A middle-class tax cut, no more income splitting, tax increases to the wealthy….what it all means to your family is only the first of many loaded questions I’ve been asked about recently. These loaded questions can be summed up as follows:

“Justin Trudeau has a majority government…so what the heck happens now in my actual bank account???!”

Also:

“Daycare in Quebec is going to cost me HOW MUCH??!!”

The daycare question will be answered IN DETAIL in my next blog post…just make sure you don’t fall off the edge of that seat while you’re waiting.

Let’s talk about that first question above – will you be paying more tax or less tax? Will you be getting more child benefits or less? Will your children be enjoying their winter in a warm, cozy no-longer-$7.30/day daycare environment while you freeze at home unable to pay your electrical bill because of those HUGE tax and daycare bills??!! (I know that makes zero sense, it was more for the visual!)

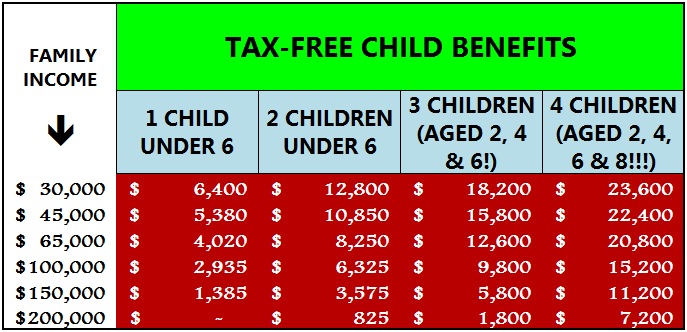

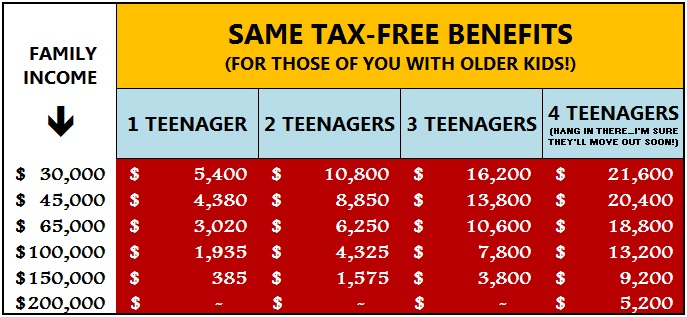

The child benefits part can be summed up in a couple of tables which you’ll find down below (as usual, really colourful and hopefully easy to understand). The taxes part goes like this:

- If your family income is over $200,000 (kids or no kids) you’ll be paying more taxes next year. Sorry!

- If your family income is between $50,000 and $200,000 then you’re better off for 2016….BUT (there’s always a but) because of the cancellation of income-splitting, if you’re in a two-income family with kids, the bigger the difference between your salary and your spouse’s salary, the less good that “better off” gets. Get it? Got it? Good! If you want more detail, please send me an e-mail…if I got into it here, it wouldn’t end well for anyone.

- If your family income is under $50,000, you’re going to just about break-even. Congrats. If you’ve got kids though….then congrats again! Check this out:

First table is for families with younger kids, the second table for those of you with older kids: (I capped the number of children at 4 for reasons stated in an earlier post….basically, if you have more than 4 kids then you’re probably not reading this post because one kid is probably using your computer right now and your other kids are currently teaming up to flush your phone down the toilet…oh the joys of parenthood…)

I know what you’re thinking – that’s A LOT of cash….or perhaps that it’s too good to be true? Well, the truth is it’s all true. The above child benefits represent a pretty big increase over the benefits of the past, especially given that the entire amount is non-taxable.

What else is changing? The old so-called “income splitting” program I mentioned earlier will be trashed (exactly where it belongs) but I will be among those lobbying their MP for the new government to come up with a new income splitting program that makes sense for us middle-class Canadians. Why was the program scrapped? The old income splitting was only available to families with kids under 18-years-old and favoured families who made more money. Nonsense! Last I checked, some families don’t have kids, some families have dependent kids over 18 and….wait for it….some families have 2 working spouses and are middle-class!

So I hope this post answered at least some of your questions. If you want more information or more detail, please comment or drop me a line. Also, stay tuned in the next few days for that post on the NEW Quebec daycare system and the benefits (or lack thereof) of the $7.30/day program!

Sincerely,

The Funny Accountant

If you like what you read, please like my Facebook page and/or follow me on Twitter! And, as always, if you have tax questions, need advice on your personal taxes, corporate taxes or anything else accounting or business related, please contact me (Mitch Kujavsky), AKA The Funny Accountant, either by phone at (514) 833-1158 or by e-mail at mitch@mkassociates.ca.

Also, for a witty and insightful read, check out the wifey’s blog. It’s funny and good.

Hi Mitch, love your blog, I’m an accountant in BC, it’s very informative! Wondering if these numbers are just for Quebec or all of Canada? Thanks!

LikeLike

Hi Lainie,

Thanks for the compliment! The numbers in this blog post regarding the new child benefits and income splitting are for all of Canada. The next one will be primarily for Quebec but there will be some content that applies to all Canadians. If I see a lot of readership in BC, I’ll be sure to do a British Colombian-only post in the future!

LikeLike

Have you heard anything about when they will scrap the UCCTB? I think there will be a lot of families that are screwed if that is scrapped before the implementation of the new benefit rates, mine included.

LikeLike

Sounds like it will be replaced beginning January 1st…it will be replaced immediately by the new means tested CCTB. There won’t be any period of time where families earning less than the new cutoff (depending on how many kids they have) will be short any monthly child benefit cash.

LikeLike

Thanks. This past year has been incredibly rough on our family financially, and that increase in the UCCTB was a life saver at the time. Things are still tight, but we are pushing through for now.

LikeLike

The CRA website is not showing new amounts for the CCTB. Has anything officially been announced? It is like that nothing has been said since the election, unless I missed something.

LikeLike

The new tax rates are in effect as of Jan 1 but the new UCB’s year runs July 1 to June 30 (uses 2015 assessed income numbers). So the new benefit will kick in July 1 (I don’t think retroactive to January)

LikeLike

[…] the less you’ll be receiving (unlike the old UCCB that everyone got a piece of). Check out my last blog post for details of how much you’ll be getting or use the CRA’s simple calculator or more complex […]

LikeLike

my daughter turned 18 on November 19th, 2016. Can I still claim her for 2016?

LikeLike

Hi Cheryl,

Unfortunately, you cannot claim an 18-year-old as a dependent unless they have a disability for which you can obtain a disability certificate. However, if she is attending post-secondary school (CEGEP, University, trade school), you can transfer her tuition credits to your tax return in order to get some of it back in 2016. If you need help with your taxes or have any other questions, please get in touch! My email is mitch@mkassociates.ca. Thanks!

LikeLike