Author’s note: this blog post talks about the UCCB increase only. For a closer look at more “real world” scenarios on how the Trudeau and Harper tax plans will affect your bottom line, please check out the follow-up post!

Full disclosure: sometimes I use catchy blog titles or gimmicky phrases to attract readers to my blog. In my defense, it works (sometimes)! In this case, however, there ain’t no gimmick. Simply put, if you have kids under the age of 18, there will be cash unexpectedly deposited into your bank account on or around July 19th. This is due to an increase in the UCCB (the federal Universal Child Care Benefit) and it’s easy (and fun!) to figure out how much:

- For each child under the age of 6: you’ll be getting $520 (and $160/month from August onwards, an increase from $100/month)

- For each child between 6 and 17 years old: you’ll be getting $420 (and $60/month from August onwards, an increase from $0/month)

If I was a Smart Funny Accountant, at this point in the blog post I would just cut and run, but I’m a masochist at heart and I love delivering bad news to my loyal readership, so here goes…

First of all, the money you’ll be receiving is taxable. So while it’ll be nice to have some cash on-hand, just remember that, depending on your tax bracket, a good chunk of that change will be headed right back the other way come April 2016. (Moral of the story, don’t spend it all right away!)

Secondly, a federal tax credit was eliminated at the same time that the UCCB was increased. This credit was informally called the “child amount” and basically reduced your tax bill by around $338 per kid. It was also a non-refundable credit, meaning you had to be earning enough (AKA paying enough tax) to make use of it…but 95% of my clients who have children were making use of it. And now it’s gone. And I am sad…(Please visualize a single tear rolling down my cheek.)

Thirdly (and only for us Quebecers with kids in $7.30/day daycare), don’t forget about that tax “surprise” coming in April 2016 if your family income is over $50,000 (which gets even more “surprising” the more you earn). Add the increased UCCB to your income and now you’re earning even more, making the big tax bill you didn’t expect even more bigger (as my 3-year-old would say)!

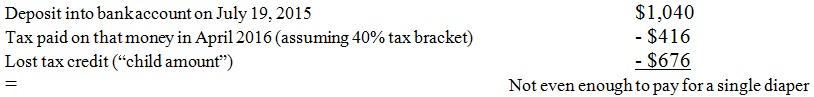

All that being said, what does all this mean?? It is an election year, so it’s not surprising that a few goodies will be tossed out for a big group of voters. I’m not going to lie, I have 2 kids under the age of 4 so I’ll be getting $1,040 ($520 x 2) deposited next month. That’s more than a few Olaf dolls and would go a long way to paying for a few days of vacation in summerrrr. But let’s be real…if you’re earning around $100k between you and your better half (and depending on a lot of other factors affecting your personal taxes), this is what that money really looks like:

So is your current government trying to buy your vote? Probably…but can you blame them for trying?

Sincerely,

The Funny Accountant

Again, don’t forget to check out the follow-up blog post!

In case you missed it, here’s the audio from my appearance on CJAD, chatting with Dan Delmar about the UCCB increase and other family related tax stuff!

If you like what you read, please like my Facebook page and/or follow me on Twitter! And, as always, if you have tax questions, need advice on your personal taxes, corporate taxes or anything else accounting or business related, please contact me (Mitch Kujavsky), AKA The Funny Accountant, either by phone at (514) 833-1158 or by e-mail at mitch@mkassociates.ca.

Also, for a witty and insightful read, check out the wifey’s blog. It’s funny and good.

If a household income of $100,000 is being split for income splitting, thenare the numbers the same?

LikeLike

Hi Lee-Ann, thanks for the question! In short, the numbers in the calculations are based on a very simple example where nothing else is considered (including income splitting). The final numbers depend on a lot of things, including how much each spouse is earning and any other credits or deductions you’re both using. Other than the UCCB amounts you’ll be collecting per month (which never change), all the other numbers will definitely change! Email me or call my office if you would like to discuss further (we can probably end up saving you some money!)

Thanks,

Mitch

LikeLike

Can I ask why you only took into account the amount of back pay and not the full year? We will each get a total of $720 per kid per year. And the assumption that many people make enough to be in the 40% tax bracket is quite optimistic. You would have to have an income of over $150,000 for that to be the case. And don’t forget that it is the parent with the lowest net income who will claim it as income.

There has been a lot of confusion with all of this, and I just want to clear up a slightly skewed view.

LikeLike

Hi Suzanne,

I simplified for the purpose of illustrating the tax impacts of the recent changes. But you’re right on target, it was a very partial example that is unlikely to happen in reality. I’m actually writing a follow-up post right now with more realistic situations and a more detailed look at the differences between the conservative and liberal tax plans (and the repercussions on families of varying income levels).

LikeLike

But you are telling people they won’t have anything and that it just sounds good. The fact is, that per kid, most families will have money left over. Take for example in Ontario. To hit the highest tax bracket, you will have to make over $220,000, and the tax rate would be 42.16%. 720×42.16% is 303.55. Take away the amount from the credit on the return, and you are still ahead by $78.20 per kid per year. As well, the UCCTB is removed from the family net income to calculate most benefits(not sure about all of them, as I am only familiar with Ontario taxes), so this increase should not affect many other benefits families receive.

Obviously when we eventually head to the polls, we need to consider more than just how much money the government wants to put in our pockets, but skewed information is making some families freak out.

LikeLike

Dude-man you’re a horrible accountant… You just compared 7 months of UCCB to a full years reduction in the child amount. You also totally misrepresented the way Canadians are taxed… You would have to have >$130,000 personal income to be taxed 40%… not family income. Also keep in mind the lower income spouse can claim the credit… You should maybe consider some math/accounting classes brosky… No offence.

LikeLike

Ok so some of your comment is true, some not so much. I’m flattered that I’m both a dude and a brosky so….thanks?

All your numbers are right on and all addressed in the follow-up posts which I would recommend having a look at.

PS – since when do accountants do math?

LikeLike

What?!? You just broke rule #1 of the Liberal play-book – “never admit that your facts are erroneous”. This can only mean one thing… You are actually an honest & nice guy that has been infected with the Liberal Ideology Virus (LIV). Don’t worry mango, there is a cure… All you have to do is read the first 5 pages of any high-school level economics text book and the virus should dissipate shortly there after. If for some reason that does not work, a quick read of politics during the late 90’s will most certainly. Don’t worry Brosky, I had it once too… shits contagious.

LikeLike

Actually, in Ontario you’d have to make a lot more than $220,000 to hit a marginal rate of 42.16% if you factor in the true situation (other tax credits,etc.) but I digress…

Again, I’ve acknowledged that the information in the post was for illustrative purposes. Am I showing Liberal bias? Heck yes. The Liberal tax plan is based on the reality of the needs of the low and middle classes and if an illustrative example helps individuals to envision the cash impact of changes to the tax code, then I’ve accomplished my goal.

I am flattered that you believe my skewed information has that much impact on individuals. But I have complete faith that if someone is really that freaked out, they’ll have the presence of mind to obtain more information, either from me or whoever their accountant happens to be.

LikeLike

I have seen several blogs posted by friends on Facebook, which is exactly how I stumbled upon yours. They see the small amount of information and pass the information around. Yes, my calculations are only taking into account the posted tax rates and not the other credits. So basically, some families may end up with even more in their pockets! I am curious to how you present the comparison though.

LikeLike

It’s always tricky…you don’t want to present too much because it won’t be readable! But at the same time, if you don’t provide enough information….well, you know 🙂

LikeLike

Very true! As someone with a little more tax background then the average person(I did take accounting in college and then worked at an accounting firm for a few years), I can absorb a little more than the average Joe, but I am not an expert by any means.

LikeLike

Thank you for writing this article. I am so sick of the conservative preying on the poor numeracy skill levels of Canadians as a marketing smokescreen to buy votes using Canadian own tax dollars.

I urge you to update your example at the end with more realistic tax numbers though. At $40k the mtr average is about 22% across Canada and at 70k it is still around 30%.

A great follow up would be a comparison of net dollars of what was before vs what the new will be.

LikeLiked by 1 person

Great comment, thanks! I’m currently writing that follow-up and will now include 2014 as part of the example (as well as comparisons of the conservative and liberal tax plans). Tough to find the balance between a realistic family’s taxes and something that people will be able to read without falling asleep but I’ll do my best! Thanks again!

LikeLike

Tell a story – make up a realist Canadian household – give them names and background and feelings. This makes it relatable to the audience and they can say ‘I’m sort of like that.’ Jasmine and Faroque live in Calgary with their three kids 10, 8 and 4 years old. Jasmine recently returned to work as a conceirge of a hotel making $32,000 a year. Faroque is a middle manager at Suncor energy making $64,000 a year with an annual bonus of about $8,000. Here is how the change to the UCCB will impact their family…

Feel free to use this. Hope it helps

LikeLike

Lol that’s awesome. I’ll give credit where credit is due (even if I change the names to Hank and Sheila!)

LikeLike

I didn’t quite make up a full blown fictional family but I think it gets the job done. Have a look when you get the chance!

LikeLike

Interested to see the update on this as our last tax return with one little baby was still a much smaller refund than we were used to (we got back $150 combined vs the $1500 we were used to, thank god we didn’t owe!).

Are you able to link to any sort of .gc.ca discussion that the “child portion” is eliminated?

I too have a strong liberal bias and would like to have concrete examples to present when questioned.

I failed university level accounting but understood your example. (I passed the 2nd time around) Thanks for presenting this information.

LikeLiked by 1 person

If you or your spouse collected employment insurance benefits(maternity benefits), they take way less tax off. They really should take more because it occasionally turns refunds into owing!

LikeLiked by 1 person

New post finished if you want to check it out! Please let me know what you think!

LikeLike

New post finished! Have a read and let me know what you think…

LikeLike

[…] are taxable nor does it mention the elimination of the “child tax credit” that I mentioned in my previous blog post. Yes, you will end up with more cash in your pocket with the increase in the UCCB. If you receive […]

LikeLike

[…] Got Kids?…Then Your Gov’t Cheque is in the Mail!. […]

LikeLike

Thanks for the witty update! And brace yourself for all the social media backlash in April ……. When those families who will not, or more realistically cannot educate themselves are shocked to learn of how these “Harper dollars” have affected their income tax bill (refund) that they are banking on. Weird though that the PC’s didn’t wait until September to deposit this windfall……??

LikeLiked by 1 person

April is going to be brutal in 2016! Especially here in Quebec where our daycare costs are going up only parents have not yet been informed of the increase (that will be billed only on our tax returns!)

LikeLike

Just wondering how the back pay goes if u r child turned 18 on June 29th 2015???

Will I get back pay from January to June???

Try to call government….. always busy!!!

LikeLike

My understanding is that you’ll receive $60/month for January to May…I don’t think you get July if your child turned 18 in the month.

LikeLike

You will get the top up Jan-June. Call 1-800-O-Canada if you ever have questions. They answer right away.

LikeLike

[…] good to be true then it probably is. In my last couple of posts, I’ve written about the current Gov’t increase in the UCCB and also wrote a more detailed breakdown of the Trudeau vs. Harper tax plans. Many have asked […]

LikeLike

I think this is misleading as you only take into account the backpay for the first half of the year, so it seems like this example leaves you in the negative, when really at 40% tax you should have $188 left over. ($1,440 total increase in UCCB – 576 tax – 676 in tax credit no longer taken). It is still not much, but the point is that this is still extra money.

LikeLike

Yes, I actually addressed that point in the follow-up blog post. I went about it like that initially to highlight the dangerous nature of the payments. But you’re right on. The point of it all is just to ensure that families are aware that the tax bill that they expect to pay in April 2016 is not the one they’re going to get.

LikeLike

Any chance on doing a follow up chart comparing all 3 parties to include the NDP?

LikeLiked by 1 person

100%! Question though – what information would you like to see in that chart? Or better yet, what data (i.e. after tax income, child benefits including/excluding daycare) would give you the best way of comparing?

LikeLike

[…] removed from your name. Over the past couple of weeks, as Canadian parents have learned about the increased UCCB payments (including the so-called “Christmas in July” lump-sum payments received this past […]

LikeLike